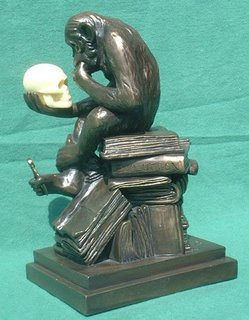

Wilmette's Monkey Business

I imagine that most people in Wilmette enjoy investing , so I don't need to review any of the literature, or the historic article, where a monkey picking stocks makes more money than highly trained investment professionals.

I imagine that most people in Wilmette enjoy investing , so I don't need to review any of the literature, or the historic article, where a monkey picking stocks makes more money than highly trained investment professionals.Today's Chicago Sun-Times column by David Roeder has the latest results from their stock-picking monkey here, and it's so funny I hope you will take the time to read it. There are also some well-deserved comments on corporations whose main business seems to be abusing the consumer that are sure to tickle your fancy.

4 Comments:

Television ads for financial institutions litter the programs I tend to watch. They are so infuriating. I think UBS states this in a recent ad: "We answer the questions you are not asking?"

What the hell does that mean?

Hi Copy Editor,

I think it means that you are watching all the shows rich people watch! Try Jerry Springer or late nite TV or cartoons and all those financial ads will go away. It also means that UBS' ad campaign is very successful because you remember the name of the company and their message. Not only do you remember it, you are telling others about it!

More seriously, as a result of change in policy, Swiss banks can no longer market bank secrecy, which they did for years. Now they are selling financial expertise. I suppose due diligence in investing means you have to ask some questions, so probably asking the right ones is important. Unless, of course, you follow the monkey's picks. He probably has better results than the Swiss, and I know that he doesn't ask any questions at all.

If UBS is trying to annoy me, they have achieved their goals.

The whole "we answer the questions you don't ask" is highly suspect. Do they not ask questions on their own? Do they assume that additional questions would have been asked? It's nonsense that sounds sort of appealing if you don't think it through.

The monkey has probably read that dividend bearing equities from mature companies are the best bet.

Well, if you understand dividends, you probably don't need UBS. I thought the monkey's picks were totally random, but you might be on to something.

I dare you to call up UBS and ask to speak to someone in Wealth Management and see what they have to say about those questions . . . Bet that one would make a hilarious post.

Post a Comment

<< Home